Why Sales Leaders Need to Focus on Double Click Metrics (DCMs) to Measure and Improve Performance

Most sales leaders love to look at their CRM dashboards and focus on metrics. Generally, all metrics can be bucketed into leading or lagging metrics. Leading metrics are used to improve performance while lagging metrics are used to measure performance.

When it comes to sales leaders, the holy trinity among metrics are ‘Closed-Won’, ‘Pipeline’, and ‘Meetings Held’. The reason is that ‘Meetings Held’ leads to ‘Pipeline’ and ‘Pipeline’ to ‘Closed-Won’. Leaders need to spend more time understanding leading metrics like ‘Meetings Held’ as there is more direct control from the sales team on these and they can be used to improve performance. While lagging metrics like ‘Pipeline’ and ‘Closed-Won’ can be used to measure performance.

While these cover the entire sales funnel, the magic happens when we ‘double click’ on them. When I say double click, I mean breaking the metric down a couple of layers. This first-principles thinking will help you come to the exact metric that needs improvement. Let’s see what some double click metrics (DCMs) across these three metrics will look like:

- Closed Won: This is the total amount of revenue booked in a measurable period, most probably a month, quarter, or a year. This metric is used to measure a sales team’s deliverables against a target set by the management team. This metric is also used to pay out incentives to sales reps based on their individual or team quota achievement. <double click>

- Average Sales Cycle: The average time taken for a deal to close from the date it entered the sales pipeline. This metric can be tracked to see the efficacy of the sales teams and/or maturity of the product-market fit.

- Average Sales Price: The average value of a deal that closed in the system. This metric allows you to predict the entry point for most customers. This information can also help in creating bundles.

- Number of Deals: The total number of deals that contributed towards the closed one. This metric is used to calculate risk in the business. If you have fewer clients, the risk is higher with customer churn than having a larger client base.

- Industry / Segment: Which industries/segments are buying us and at what average sales price. This helps us understand if we have the product – market positioning right.

- Performance Spread: How many sales reps are contributing to the closed-won. You can always have some superstars but you should have at least 80% of the team contribute in every period measured.

- Pipeline: This is the total amount of opportunities that have a likely closure in the given time period. This metric is used to predict if a team will be able to reach their closed-won targets. Typically a team will use historical data to decide if the pipeline needs to be 2x, 4x or even 8x of the closed-won needed (often called Pipeline Coverage). <double click>

- Aging: The time a deal has been in the pipeline since inception. Also, aging can focus on the time a deal has been in a particular sales stage. For example, this deal has been 20 out of the 30 days in the demo stage (which is 4x longer than the 5 day average for this stage), what’s going on there? This can be used to understand the health of a pipeline. Also having multiple deals in multiple stages is a good sales motion. For example, having everyone in the contracting phase may overwhelm the legal team.

- Average Sales Price: What’s the average sales price of the deals in the pipeline. This metric allows you to gauge the confidence of a team or team member to sell big. Most under-confident reps and managers will have smaller deal sizes. It also allows you to differentiate whether your team is productive or just plain busy.

- Performance Spread: Like closed-won, what channels are contributing to your pipeline? Again here, you need 80% of your reps contributing with some of the stars picking up the slack of the laggards.

- Meetings: The number of meetings is a great way of understanding how productive the team is being and how the pipeline will develop. This metric is good to uncover what kind of personas are interested in our products and services. The qualitative feedback from meetings can also give an insight into current positioning gaps, competitive scenarios, and product feedback. <double click>

- Source of Meeting: Were these meetings set by the AE, SDR, and/or a marketing lead. Who is contributing to these meetings and why are some lagging.

- Email Open Rates: As emails are the biggest source of meetings, it’s important to measure the open rates of the emails sent. This metric helps understand whether the sales reps are targeting the right person, whether your domain/brand is respected and/or the subject line is effective enough.

- Email / InMail Response Rates: While open rates are a good metric, the best one to measure email effectiveness is response rates. The response may be positive or negative. This metric is used to measure the value created by the sales rep by personalizing their messaging based on the client’s industry, role, and needs. It is majorly dependent on the insight shared and the call to action.

- Email Unsubscribe Rates: While open and response rates are crucial for setting up more meetings, unsubscribe rates point out to the lack of homework done by a sales rep in reaching out. While the timing may be an issue sometimes, most of the time this metric points towards spammy email copy, generic messaging, and distrust.

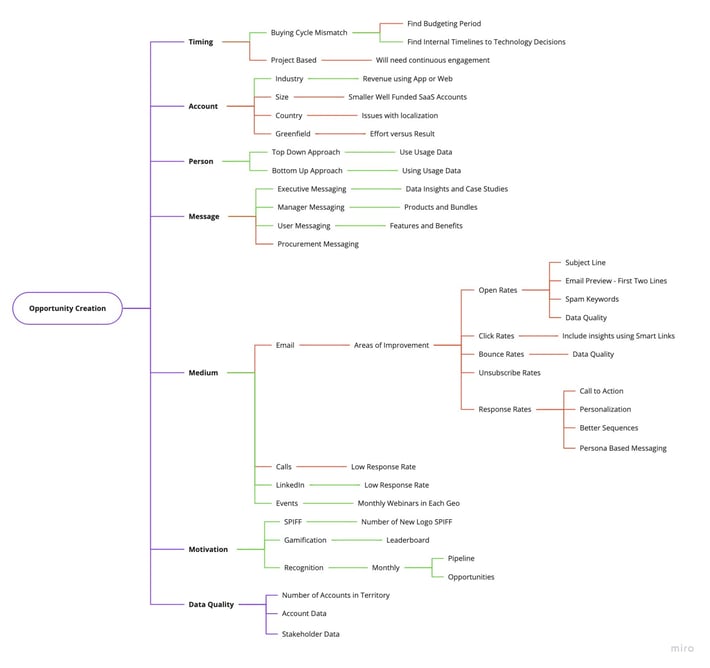

Let me illustrate all we have discussed with an example; if my team needed to hit their quarter number of USD $10 million across 50 reps, each rep would need to do $200K. With an average deal size of USD $20K, each rep would need to do 10 deals a quarter. To hit 10 deals, reps needed to at least have 20 opportunities in the pipeline. Opportunity creation can be because of multiple factors as shown below

Let’s break down opportunity creation to email prospecting. Historically, my team needs 3 meetings to get a deal in the pipeline. So we now needed 60 meetings to create 20 opportunities. For 60 meetings, with a 20% positive conversion rate, we need at least 300 responses from email prospecting. For 300 responses, we would need to send 6,000 emails a quarter at a 5% response rate. Now, I can start tracking these metrics to understand how well we are tracking towards hitting our numbers. Similarly, you can break down opportunity creation into other factors that you can measure and track.

To reap the maximum benefit of these double click metrics (DCMs), you will need to work with your sales operations and marketing team to set benchmarks using forecasting models or historic data or industry data like how MailChimp shares Industry Data for Email Responses. Then you measure your progress across each of these metrics daily, weekly, or monthly. These metrics give you an understanding of not only results but also underlying trends, models, and behaviors.

A Few (Related) Sales Posts

Read full post: Strategic Sales Pipeline Metrics for Effective SDR Management

Read full post: Strategic Sales Pipeline Metrics for Effective SDR Management

Strategic Sales Pipeline Metrics for Effective SDR Management

Featured image: How to Read Cold Email Stats in B2B - Read full post: How to Read Cold Email Stats in B2B

Featured image: How to Read Cold Email Stats in B2B - Read full post: How to Read Cold Email Stats in B2B

How to Read Cold Email Stats in B2B

Read full post: The Bridge Group SDR Metrics Report 2021: Post COVID-19 Reality

Read full post: The Bridge Group SDR Metrics Report 2021: Post COVID-19 Reality