BANT vs. NOTE: The Ultimate Lead Qualification Guide

Lead qualification is a way to define which leads require more time and effort, which should be contacted right away, and even which ones should be disqualified from your sales efforts.

There are plenty of methods to do that, and you’ve probably heard of some like BANT, NOTE, NEAT, or MEDDIC. With a great variety of options, comes a great load of questions.

Is BANT outdated? Is NOTE better than BANT? Why is one lead qualification methodology better than another? This guide is designed to answer those questions and help you accomplish two critical things:

- Understand the pros and cons of different lead qualification practices, and

- Use the right method to enable your sales teams with the tools to focus on the named accounts that are most likely to turn into closed-won deals.

Lead Qualification

B2B buying and selling have never been more complex, especially with virtual selling the new norm. The sales process has become longer, with more decision-makers involved, and higher stakes – including personal ones: professional reputation, career growth, and respect from colleagues. Everyone on the buying team wants to be sure that they’re making the right decision. Everyone on your sales team wants to know that as well. LIvelihoods are at stake, and the future of each company hangs in the balance.

Firstly, you’ve got to start with the high-quality leads that match your ICP and Buyer Persona. Later, sales reps engage, warm-up, and set appointments with the leads. However, can you be sure that those efforts won’t be dust in vain? Will you know what prospects need immediate action to become long-term customers?

With the right lead qualification process, you can and you will increase the velocity of your sales funnel from the top down.

What is Lead Qualification?

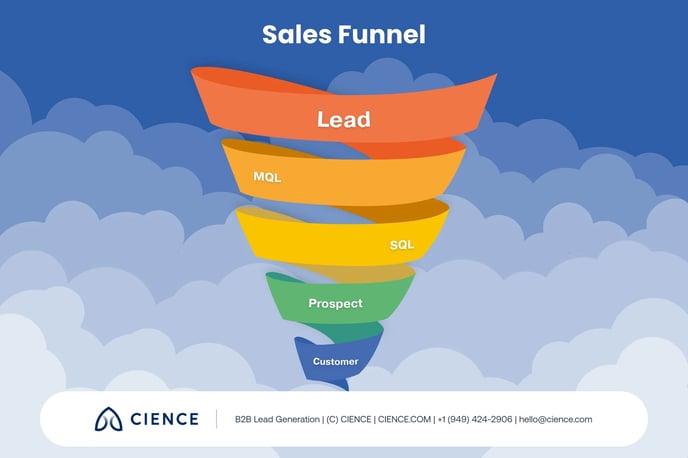

Lead qualification is a process of evaluating and determining whether a lead is qualified enough to go further through a sales funnel (move from being a lead to becoming a prospect).

Sounds easy, right? But like many things, the devil is in the details, so let’s dive in. There are two general ways for how organizations acquire a lead.

A) A website visitor fills out a form or requests information through the inbound channels: form fills, newsletters, blogs, ads, social media, webinars, etc. They are tracked by your marketing team and later are contacted by your sales reps.

B) A professional researcher you’ve hired provided you with a list of leads. Later they are contacted by your SDRs who introduce them to your value proposition and set qualified meetings.

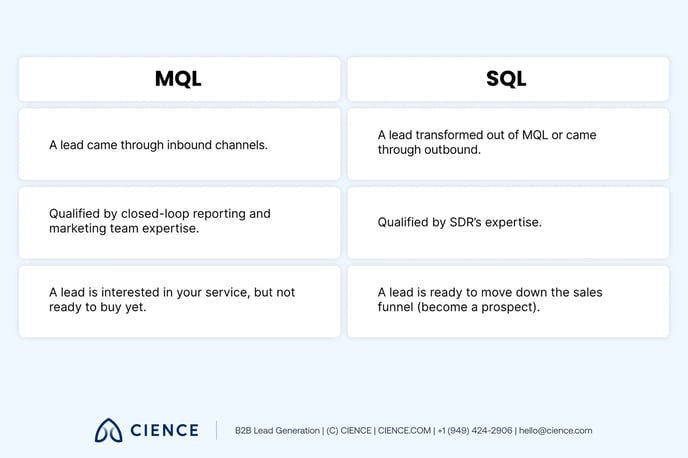

Regardless of which acquisition channel, a lead becomes an MQL (Marketing Qualified Lead), marketing and sales need to be aligned on the criteria to move an MQL to become a Sales Qualified Lead (SQL).

Though these terms may sound similar, make sure you know the difference.

Let’s walk through a common inbound acquisition sequence.

- Your website had 400 visitors on Tuesday.

- Five filled out a form for your buying guide, three engaged with chat, and one used the Contact Us page to inquire about your product.

- Based on this closed-loop reporting, these nine visitors become MQLs. They’ve expressed interest, though that is not enough to become a true prospect yet.

- Typically, an Inbound SDR attempts to set a qualified meeting with the appropriate Sales Executive, if the lead proves to be sales qualified.

- Of those 7 MQLs, it turns out that only 2 of them are actually sales qualified. However, the SE had to disqualify them.

- The Sales Exec begins to distrust marketing because only 2 out of 7 of his or her discovery calls were with non-fit companies. The SE lost a minimum of 2.5 hours (not including call prep time) of their day (or 30% of their working day) holding a discovery call with prospects who would never be a legitimate sales lead.

This scenario paints a picture that is more common than most marketers would like to admit. And it is precisely why having an iron-clad, sales-aligned lead qualification process is so important even before the discovery call.

When nurtured correctly, MQLs can be transferred to the sales team to become Sales Qualified Leads (SQLs). Depending on the lead qualification methodology your company chooses, your SDRs will ask a series of questions regarding the need, budget, challenges, authority, goals, or plans of a lead.

By asking the right questions, your sales team will know whether the lead is the right match for your business or not. And that is a lead qualification process.

Why Is Lead Qualification Important?

According to Hubspot, only 21% of new leads convert into sales. That conversion rate makes it critical that those deals in your pipeline are moved from opportunity to closed-won as efficiently as possible to maintain a Cost per Acquisition model that fuels scalable growth.

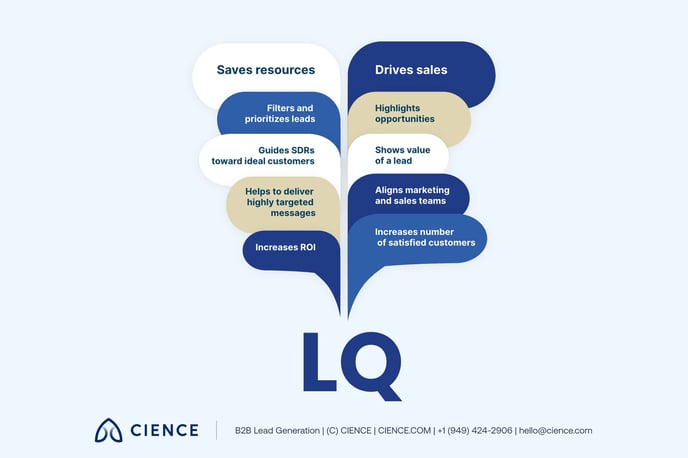

Lead qualification saves your company money, time, and effort that can be reinvested into big game hunting and expanding current accounts. And that’s not even all.

Things to Do Before Lead Qualification Starts

1. Define your criteria for qualifying and disqualifying a lead. Your standards should depend on your quantity to quality ratio. Meaning, if you want to get five solid leads you’ll have strict borders of what works and what doesn’t.

For instance, a lead replies to your email with a request for more information on service of yours. If nurtured correctly, this lead can be qualified. If a lead never opened an email from you, he should probably be removed from your target list.

2. Use lead scoring. Lead scoring is a process of assigning different values to your leads based on their actions.

For instance, you have two leads that opened your email.

- Lead A opened your email 2 times and clicked on the LP link.

- Lead B opened your email once and did not click a link.

Based on the lead scoring principle, Lead A will have a higher score than Lead B. Therefore, Lead A ought to be prioritized over Lead B.

3. Choose a lead qualification methodology. It is crucial. Lead qualification methodology defines what characteristics of a lead matter the most for your business goals, which qualifying questions to ask, and what value prop and message you deliver. Remember: Your goal is to bring value and start a sales conversation, so try to make your methodology as buyer-centric as possible.

Sales Lead Qualification Methodologies

In the pre-Internet era, buyers lacked access to information. The first Lead Qualification Methodologies (LQMs) served sellers, exclusively. However, with the rise of the digital era, the decision-makers have more information than ever before.

This fact is a double-edged sword. On one hand, buyers are more well-versed in solutions in the market. On the other, many buying committees suffer from buying analysis paralysis.

The impact of a bad purchase decision became more significant for both a buyer and a seller. In the world of ratings and reviews accessed, providing services to a bad-fit company is as damaging to a reputation as failing to fulfill obligations. Poor fit companies tend to churn at a faster clip and can leave poor reviews that potential future customers will read.

That’s how, and why, new LQMs were born. The sales process had to adjust to the new, well-informed, and savvy buyer. Modern SDRs not only ask buyer-centric “killer” questions and listen to what decision-makers have to say. By doing so, you find the best customer possible and bring value to the customer itself.

Names of Lead Qualification Methodologies are usually easy to remember because they are acronyms. The first letter of an LQM name represents what point is the most crucial for this framework. There are plenty to choose from, so let’s dig in deeper to find which one fits your company best.

ChAMP

Challenges – What challenges do you have that my service can overcome? Authority – Am I contacting the right person?

Money – Do you have the budget for my service?

Prioritization – Are these challenges a top priority for you at the moment?

ChAMP places the challenge (or the need) in the foreground. Ask questions based on the knowledge of the problems your potential customers may be facing. If there are none (it is unlikely), it’s better to stop the conversation. We also like the challenge criterion because it’s buyer-centric, rather than seller-centric.

ANUM

Authority – Am I contacting the right person?

Need – Is there a need for my service?

Urgency – How urgent is your need for my service?

Money – Do you have the budget for my service?

This lead qualification methodology puts Authority above all. It makes sense because if you don’t speak to the right decision-maker, there’s little chance you can sell anything. One downside is that this heavy emphasis on “authority” de-emphasizes others on the buying committee. This model leans too heavy towards the C-Level, who are much harder to engage than mid-level prospects.

FAINT

Funds – Do you have the funds for my service?

Authority – Am I contacting the right person?

Interest – Are you interested in my product?

Need – Is there a need for my service?

Timelines – How urgent is your need for my service?

Interestingly, Funds aren’t equal to Budget. According to the creators of FAINT, many purchases are made despite the lack of a set budget, prior to need. If sales reps can explain the value of the purchase, buyers could find the necessary amount of money for your product. So the essential advice here is: sell where the money is.

MEDDIC

Metrics – What are the results of the solution implementation?

Economic Buyer – Am I contacting the right person?

Decision Criteria – What are your criteria for making a purchase decision? Decision Process – What is the process of making a purchase decision?

Identify Pain – Is there a need for my service?

Champion – Who can help me sell my product within your company?

This one sounds cool; it’s true. Medics save our lives all the time. However, will you remember what each of those letters stands for? Double D’s can confuse, and it’s not the only thing.

Why ask about the metrics first? It’s nice to show them the benefits your service will bring but after you find out they have a need for it.

GPCTBA/C&I

Goals – What are your goals?

Plans – What do you want to achieve in the nearest future?

Challenges – What challenges do you have that my service can overcome?

Timeline – How urgent is your need for my service?

Budget – Do you have the budget for my service?

Authority – Am I contacting the right person?

Negative Consequences – What are the results of doing nothing?

Positive Implications – What results will the solution implementation bring?

Though this methodology confuses with the number of components, it is useful. Consequences and Implications can help leads understand whether the service is worth purchasing. If negative Consequences aren’t severe enough and Implications aren’t beneficial, a lead won’t convert into a buyer.

The Goals, Plans, and Challenges part can be easily converted into one category that matters – Need. So the suggestion here would be to use a framework with a more compact and straightforward format.

NEAT

Need – Is there a need for my service?

Economic Impact – What results will the solution implementation bring?

Access to Authority – Am I contacting the right person?

Timeline – How urgent is your need for my service?

NEAT is a customer-centric LQM. Need is at the top, but it is also backed up by the Economic Impact (similar to Positive Implications from GPCTBA/C&I). It implies an emotional aspect attached to any purchase. You want to help your customers! The data on how your solution can improve their business will speak to the logical side, which is a bonus as well.

NEAT brings us to the section of the most used lead qualification methodologies: BANT and NOTE. Why leave them till the end? There is a polemic conversation about which one is better, and we unpack why NOTE is a better LQM for today’s b2b buyer.

BANT and NOTE

What Is BANT?

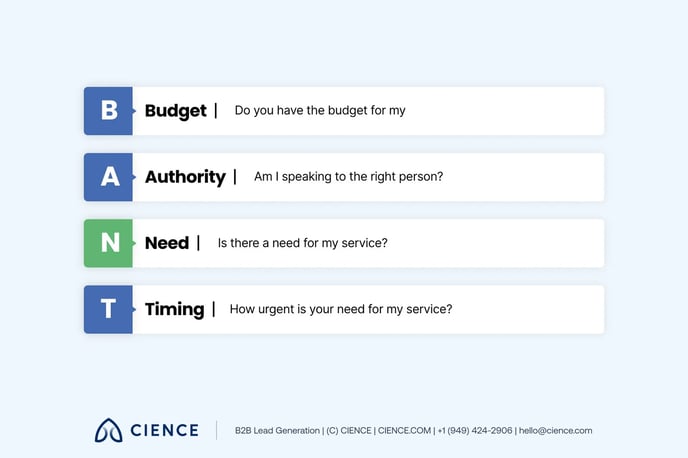

BANT is a seller-centric lead qualification methodology used by salespeople during the discovery stage to determine the probability of the lead converting into a sale. BANT was extremely popular in the 20th century and offered four criteria that helped reps to figure out whether they were talking to the right person from the right company. The key goal of BANT was to save time for sales.

Developed by IBM in the 1950s, BANT is the oldest known lead qualification method. BANT was pretty much the reflection of that era. It was introduced as a method to quickly identify and validate opportunities during a conversation with a potential client. In other words, it helped to filter out the companies that didn’t have money, as well as the wrong titles within these firms. It’s worth pointing out that BANT heavily favors the seller, as the methodology is first seeking to weed out those without budget or authority to buy products.

Breaking Down BANT

BANT was one of the first lead qualification methodologies widely adopted by sales organizations. It’s still popular because it’s laconic (only four criteria), easy to spell, and memorable. Each of its components is important, but they are ordered in terms of priority. If your prospect doesn’t meet any one of the four, it’s a deal dead in the water.

“B” is for Budget. Back in the day, it was a critical question for an IBM rep who was selling machines at the price of a house. Though being a crucial element for the buying process, it may not work out with a modern B2B buyer. Imagine if someone calls you about a car purchase, and the first thing they ask not whether you need it but rather do you have the money for it.

“A” is for Authority. You should handle this one carefully because the Authority has the potential to become a confrontational topic. Not all of the buyers are eager to admit they have little command over decisions within a company. Sometimes, however, the most important decision-maker isn’t who you would expect it to be.

“N” is for Need. The Need is a universal criterion and quite favorable to the buyer, despite the previous two questions which may prevent the Need from being discovered. It is essential since it brings you a customer that has a high motivation to buy, because of the pressing need.

Why is Need a third-order qualification in BANT? From a seller-centric point of view, if a potential customer does not have the budget to purchase a product, it doesn’t matter what their needs are. This highlights why BANT focuses more on selling and less on the relationship with future customers.

Finally, the “T” stands for Timing. We can read it this way: How soon can you buy from us? How urgent is your need? It was essential to move quickly back in the 1950s since new technologies were being developed faster than ever and the competition was fierce. But the technology hadn’t kept up with how b2b sales happen.

This is a thing that hasn’t changed since the ‘50s. Although our buying process is longer now, we still need to move fast to prevent losing a client to a competitor.

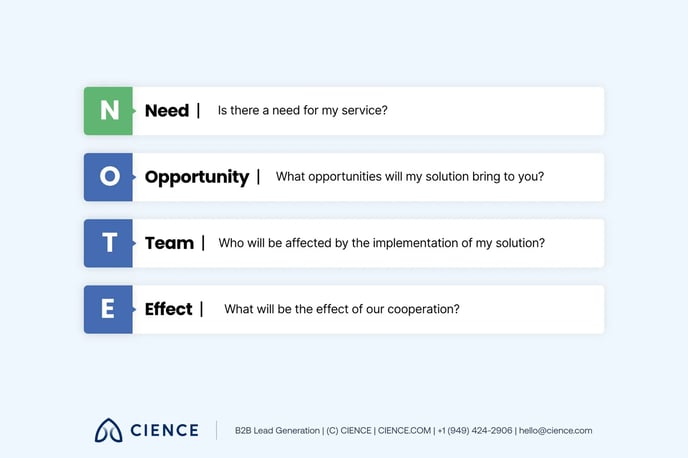

What Is NOTE?

NOTE is a buyer-centric lead qualification methodology used by salespeople during the discovery stage to determine the probability of closing deals with a lead.

NOTE was first introduced by Sean Burke, then CEO of KiteDesk. Our sales team successfully adopted it as a part of the CIENCE sales process, and we’ve been applying it to every leader since. If you have a discovery call with any of our Account Executives, chances are high you’ll experience NOTE in action.

Sean Burke created NOTE as an alternative to BANT, ChAMP, and other qualification methodologies during the discovery calls. He didn’t like their seller-centric approach. In the era of buyer-centrism, sales managers needed a tool that helped them build relationships and articulate value in terms of buyers’ understanding. This leads to more efficient B2B communication and faster, more accurate lead qualification.

Breaking Down NOTE

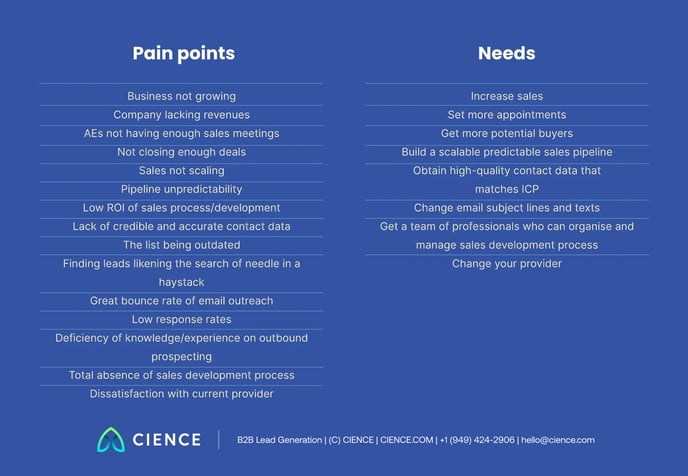

Need. There should be a good reason to make a purchase. And when it comes to B2B, that reason is a business need. However, do not confuse needs with pain points.

A pain point is the feeling of depletion (e.g., lack of leads) or redundancy (e.g., high bounce rate) of something in your business. It doesn’t necessarily mean that you’re going to do something about it.

Need, on the other hand, is the understanding that you should act. There is motivation to improve a business function, reduce overhead, increase revenue, etc. You can either fill the gap (e.g., when you hire lead generation company) or remove the harmful stimuli (e.g., when you stop using purchased contact lists). When it comes to the complex solutions in B2B, it can be both.

Here’s an example of pain points and needs of CIENCE clients:

To master the Need stage, you should:

1. Learn to distinguish Pain Points (feeling that something’s wrong) and Needs (knowing what should be done about that feeling).

2. Help your potential clients process their Pain Points into perceived Needs through open questions and education.

Opportunity. A perceived need isn’t enough for a potential buyer to take action. How urgent is the need? What are the outcomes of solution introduction or non-introduction? How much value will your prospect get if they decide to address their need? This is what you discuss with a potential client at the Opportunity stage.

Opportunity discovery is meant to summarize and scope how much a client stands to benefit from working together – in their words. It must be their opportunity (hence the buyer-centric nature of the methodology). Show every benefit for potential clients, especially if it’s hard for them to get a full picture in their heads.

Now that you’ve helped articulate and summarize and scope the benefits of making a change to the current status quo, it’s the right time to find out who else needs to be involved.

Team. Your service or product helps specific groups of people, the teams. Make sure you know the members of these teams and the decision-makers.

The team stage is important for two reasons:

1. You will be working with actual people (this is especially true for complex solutions and services). It’s vital to be on the same page about how things should work, especially for team members who will ultimately come at problems from entirely different angles.

2. Any B2B buying process involves many decision-makers. For an entity to make an informed purchase, everyone on the buying team should understand what problems your service solves and why they need them. The “Team” is about the people in the company who will be affected by the purchase.

At this stage, you will find out if a company that appeared to be a perfect fit doesn’t have the team composition that you can serve well.

Effect. At this point, you discuss the details of cooperation, as well as the expectations of your potential buyer, i.e., the desired results. What will success look like for your future customer after they buy from your company?

As a rule of thumb, when purchasing a solution for the first time, companies lack an understanding of how everything works. They have a general idea rather than a step-to-step plan in their mind. Implementation can look very different from the hypothetical solution that hasn’t been tried yet.

The Effect stage brings you (the seller) and them (the buyer) to the same side of the table. Together, you both take a clear look at your solution and their expectations (the latter can be adjusted in some cases).

What should be discussed at the Effect Stage:

1. Timeline – “How soon do you expect the first results?” “What results do you want in one month/quarter/year of our cooperation?”.

2. Scope – This encompasses every aspect of your lead’s challenges, anything you can measure or describe in clear, descriptive terms.

3. Volume – “Let’s figure out how many products you need to solve your problem?” “We provide Service 1, Service 2, and Service 3 along with Service 4 that supports them. Let’s discuss in detail which service combination will be best for you”.

Remember, the ultimate goal of NOTE is to sort out best-fit companies and filter out the rest. NOTE accelerates sales cycles and simultaneously weeds out companies who would likely stall later in the pipeline.

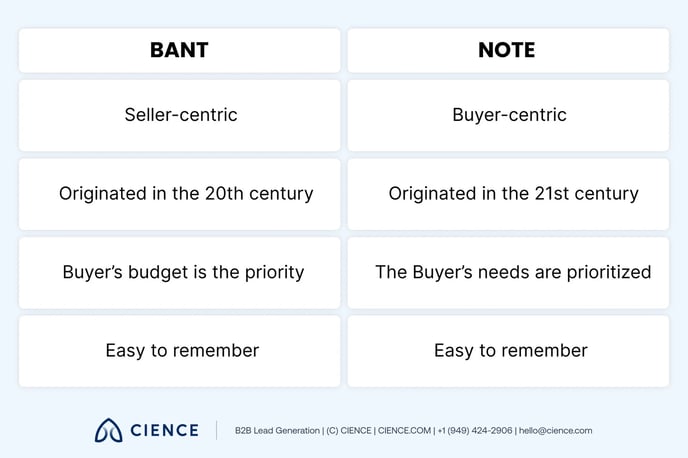

BANT vs. NOTE

Let’s see if these two lead qualification methods are that different or not.

So which one is better? Well, in modern B2B sales where you need to bring value to your customers, any buyer-centric method has the advantage. CIENCE chose NOTE over BANT because it has proven better at qualifying prospects and accelerating deals in the pipeline.

The new digital, information overload environment requires new methods and techniques to sell B2B services. We need to create new customer-oriented approaches to succeed in business and help our clients.

NOTE is an excellent example of these approaches. It enables a seller to build rapport around what matters to the buyer, not the seller.

It helps establish trusting and respectful relations between a salesperson and a lead even if they decide not to proceed to the next stage of the buying process. It provides an opportunity for sellers to educate their leads and generate value for them from the very first meeting.

Most importantly, NOTE fosters the sales process, speeds up the deal closure, and steadily fills your pipeline with the best-fit customers.

Conclusion

Lead qualification is a necessary procedure for your B2B sales process. It saves your resources, helps your teams find most fitting customers, and fastens your sales cycle.

We’ve looked through plenty of lead qualification methods, and though we use NOTE over BANT, our advice would be – use any method that works for you. Most importantly, use one.

The key takeaway here is that lead qualification is indispensable for your lead generation.

If you need help with it, you know where to find us.

Got any LQ questions left?

A Few (Related) Sales Posts

Read full post: B2B Appointment Setting: A Guide for B2B Sales

Read full post: B2B Appointment Setting: A Guide for B2B Sales

B2B Appointment Setting: A Guide for B2B Sales

Featured image: Effective Outbound Lead Generation Strategies for 2023 - Read full post: Effective Outbound Lead Generation Strategies for 2024

Featured image: Effective Outbound Lead Generation Strategies for 2023 - Read full post: Effective Outbound Lead Generation Strategies for 2024

Featured image: Appointment setter skills - Read full post: 6 Skills of a Successful Appointment Setter

Featured image: Appointment setter skills - Read full post: 6 Skills of a Successful Appointment Setter